Free Fitness Tracker for your Finances

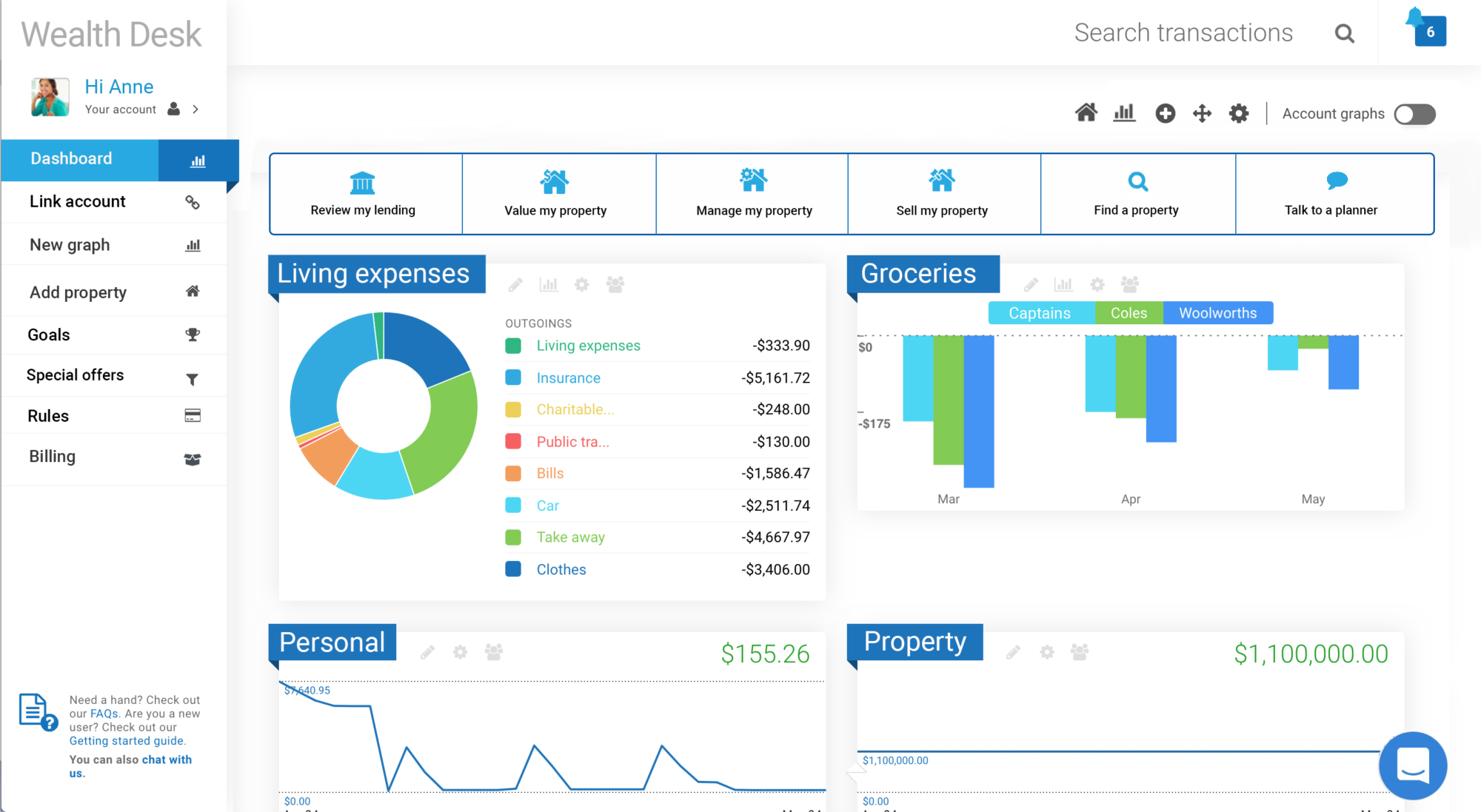

See all your accounts in one portable place

Keep an eye on your accounts and investments — including mortgages, personal loans, super, property, shares and credit cards.

Then create customised searches for anything you like.

Your financial fitness tracker

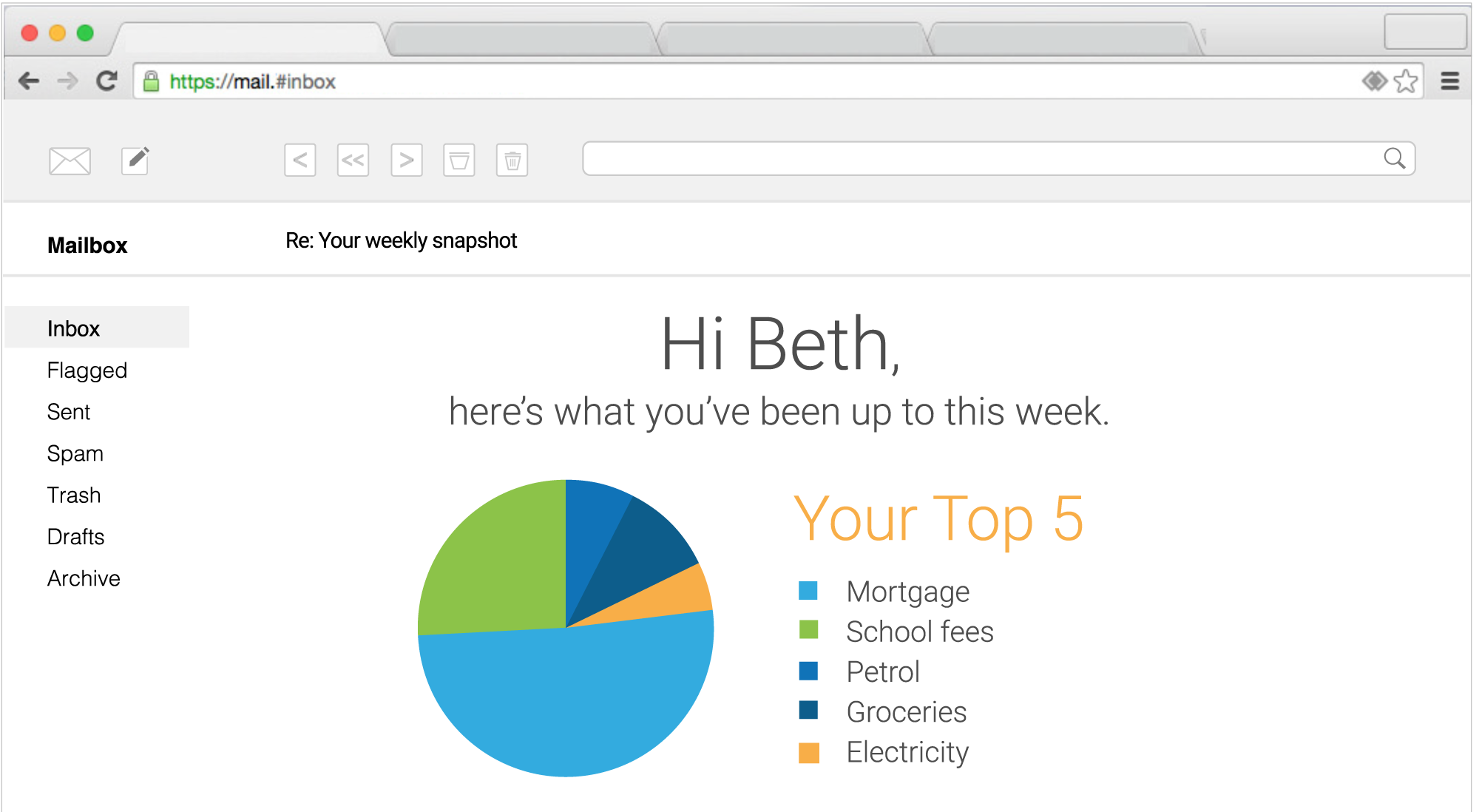

We'll send out a weekly snapshot to keep you posted on what's happening inside the app.

It will show you where your money's going, how your spending is changing over time, how you're tracking towards your goals and any offers we've found to save you money.

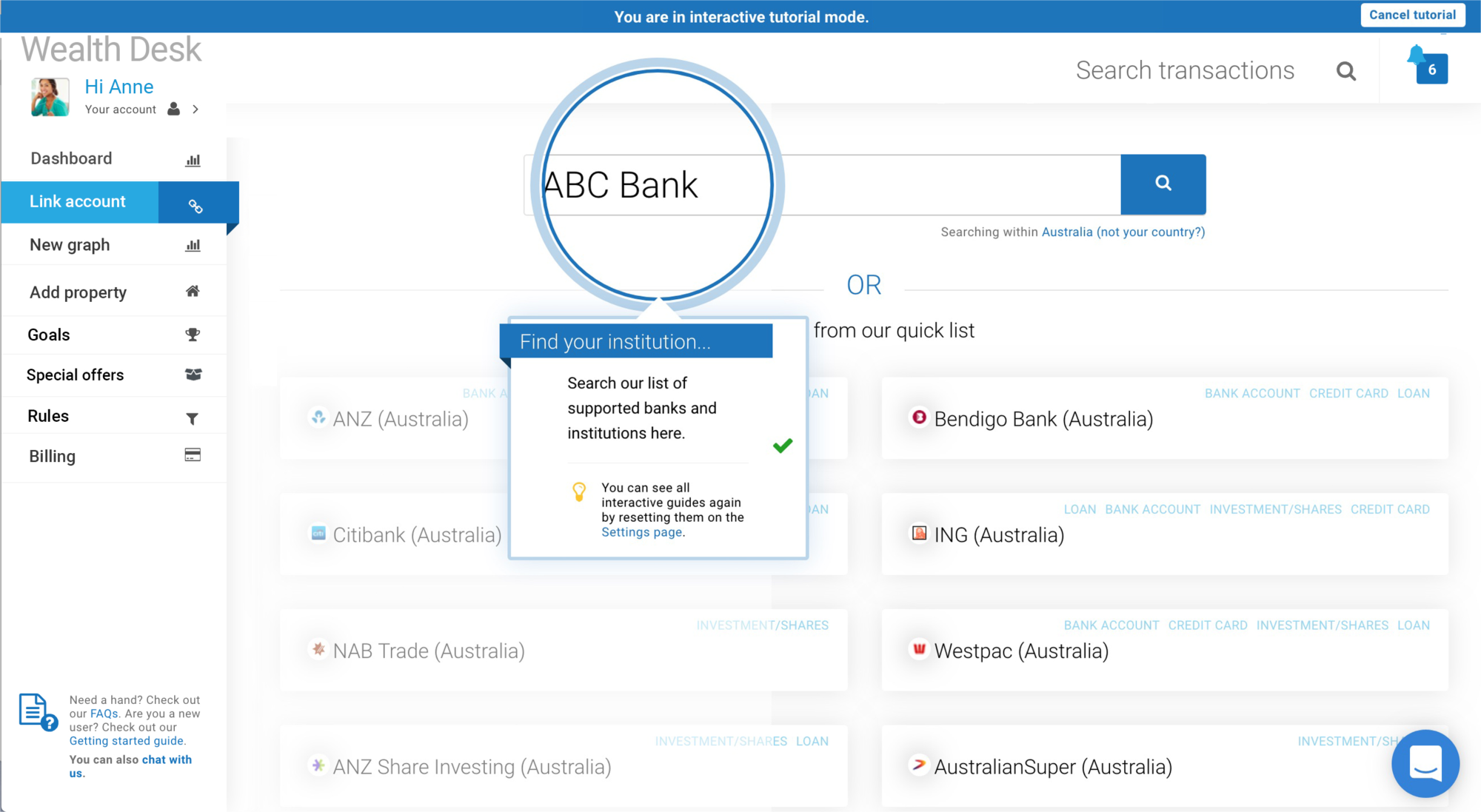

Easy guided setup

Automated tutorials at every stage will help you get started and local, in-app support is always there to help.

With direct links to us, we can offer you targed advice as you need it.

Overview

To help you to control your finances and maximise your borrowing power, MyMoney - Money Tracker has implemented a wealth management platform to make your life easier. The platform allows you to connect all of your bank accounts, credit cards, loans, properties and super funds to a single, secure dashboard. You can also create goals and reports and monitor your expenses which will be automatically categorised for you.

Why should I use this service?

More than ever, it’s important to track your money particularly when you’re seeking credit from a lender. This platform allows you to see all of your money and assets at a glance. It will also proactively help you keep track and get into good financial shape. Think of it like a fitness tracker for your finances! We recommend using this platform often before and after securing finance.

It helps us help you

Using the platform also helps us to stay up to date with your needs. You can share information with us quickly which makes providing the right advice at the right time easier. You always have complete control of what is being shared and what is not.

Accounting and tax time is a breeze

The platform can help you manage your finances and easily gather information needed at tax time. For example, you can tag all of the things you want to claim and report on them instantly.

Sign up is secure and fast

It only takes a few moments to set up and uses the same online security systems as your bank. If you need help at any stage just let us know.

MyMoney

You currently pay various fees on your investments which are used to pay commissions. For many Australians, there are thousands of dollars that they can recover. If you have:

- Managed Investment funds

- Cash Management Funds and Term Deposits

- Superannuation or Pension funds

- Margin loans

MyMoney will collect these commissions and refund them to you as monthly cash payments direct to your bank account. Find Out More...Our Service

Our refund service

Here’s how MyMoney will help you get Refunds on your financial products.

By nominating MyMoney as your financial intermediary we will:

- Collect all trail and renewal commissions and on your investments products you nominate;

- Pay them to you monthly direct to your nominated bank account;

- Ensure that all existing entry fees (between 0 and 5%) applying to your investments and superannuation accounts are reduced to NIL. This ensures that 100% of any future contributions to your investments or super are working for you;

- Provide you secure on-line access to monitor your transactions on your MyMoney account;

- Provide a monthly activity statement showing all commission transactions on your investments;

- All this for for a low annual fee. See Our Fees

We are able to collect commissions on all of these financial products:

- Managed Investment funds

- Cash Management Funds

- Superannuation or Pension funds

- Margin loans

- By registering with the MyMoney service your investment products do not alter, you remain in total control and with 100% ownership and there are no new products to purchase. You will continue to deal with these products as you did. The only change is the nomination of the financial intermediary so that we can collect and refund you the commission.

Why MyMoney?

- We pay each and every month direct to your bank account;

- We cover all fund managers ;

- Our fee structure ensures that you will always get a refund, even for low commission amounts

- There is no joining or upfront fee;

- Consolidate financial products into one MyMoney account to maximise your refund;

- Secure access to your information

MyMoney is a NON-ADVISORY SERVICE. WE do not provide financial planning investment nor strategic advice.